The International Trade Blog Export Forms

CAFTA-DR: What Is It and Why Should You Care?

On: October 18, 2021 | By:  David Noah |

4 min. read

David Noah |

4 min. read

CAFTA-DR is a free trade agreement among the countries of Central America, the Dominican Republic and the United States that went into force in 2006. It was designed to promote trade between these countries by eliminating tariffs over the course of 15 years. In other words, the main goal of the Dominican Republic-Central America Free Trade Agreement is to stimulate trade among these nations by making it more cost effective than ever.

CAFTA-DR is a free trade agreement among the countries of Central America, the Dominican Republic and the United States that went into force in 2006. It was designed to promote trade between these countries by eliminating tariffs over the course of 15 years. In other words, the main goal of the Dominican Republic-Central America Free Trade Agreement is to stimulate trade among these nations by making it more cost effective than ever.

So the good news is that if you are exporting to El Salvador, Guatemala, Honduras, Nicaragua, Costa Rica or the Dominican Republic, you may not have to pay tariffs on your goods!

As of 2015, 100% of U.S. consumer and industrial goods exported to these CAFTA-DR countries are tariff free. Tariffs on agricultural products were completely lifted in 2020. And by the time the agreement is fully implemented on Jan. 1, 2025, all goods will be duty free.

Why You Should You Care about CAFTA-DR

Why You Should You Care about CAFTA-DR

Since the U.S. government has made it more cost effective to export goods to these Central American countries, many U.S. companies like yours have responded by both developing new export relationships with and increasing their exporting to the countries included in the CAFTA-DR. Here are the stats to prove it:

- The total value of U.S bilateral trade with CAFTA-DR partners increased 46% from 2005 to 2020, from $35 billion to $51 billion, according to the U.S. Census Bureau.

- U.S. exports to these countries have grown 61% since 2005, before the agreement first entered into force. In 2020, U.S. companies exported $27.3 billion worth of goods, making the CAFTA-DR region the third largest export market in Latin America (only behind Mexico and Brazil).

- In 2020, the Dominican Republic was the largest market for U.S. exports among the CAFTA-DR countries at $7.5 billion, followed by Guatemala ($5.8 billion), Costa Rica ($5.7 billion), Honduras ($4.2 billion), El Salvador ($2.6 billion) and Nicaragua ($1.4 billion).

- Guatemala has seen the biggest growth (107%) in U.S. exports since the agreement entered into force, although all the markets have experienced solid growth, most of at least 50%.

- Key U.S. exports to the CAFTA-DR countries that have experienced significant growth since the implementation of the agreement include petroleum products (the largest U.S. export category), machinery, electrical/electronic products, cotton yarns, cereals (wheat, corn, rice), plastics, motor vehicles, paper products and medical instruments.

How to Declare That a Good Is Originating

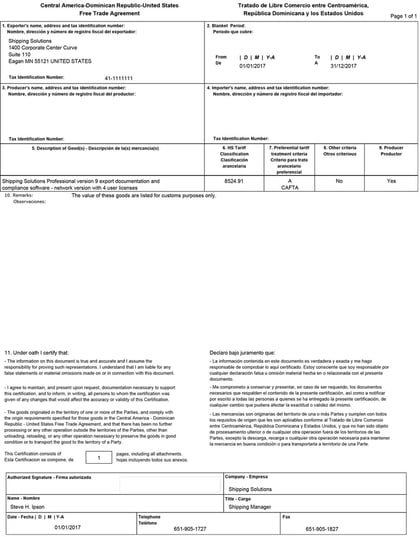

Of course, to receive tariff-free treatment under the free trade agreement, your products must meet the relevant rules of origin. The importer is responsible for making the claim and should work with the U.S. exporter to ensure that the U.S. good qualifies. The exact manner for doing so is determined by the individual signatory countries. While there is no specific certificate of origin form that must be used, there is a commonly used CAFTA-DR Certificate of Origin form, which you can download here.

The importer may make a claim for preferential tariff treatment using one of two options:

Option 1

A written or electronic certification by the importer, exporter or producer.

Option 2

The importer's knowledge that the good is originating, including reasonable reliance on information in the importer's possession that the good is originating.

The Rules of Origin for CAFTA-DR were largely modeled upon the North American Free Trade Agreement (NAFTA) and the U.S.-Chile Free Trade Agreement. However, there are some important differences that U.S. exporters should understand. Read CAFTA-DR: Determining the Rules of Origin for more information about the rules of origin.

How to Create the Documents You Need

Shipping Solutions software makes it easy to create accurate export documents, including the CAFTA-DR Certificate of Origin, as well as more than two dozen other export forms including certificates of origin for Chile, Colombia, Korea, Panama, Peru and the U.S.-Mexico-Canada Agreement (USMCA). Click here to register for a free online demo of the software.

Or you can download a free PDF template of the U.S.-CAFTA-DR Certificate of Origin form.

Like what you read? Subscribe today to the International Trade Blog to get the latest news and tips for exporters and importers delivered to your inbox.

This post was originally published in August 2014 and has been updated to include current information, links and formatting. Some of the information in this article is based on a blog post written by Sue Senger.

About the Author: David Noah

David Noah is the founder and president of Shipping Solutions, a software company that develops and sells export documentation and compliance software targeted at U.S. companies that export. David is a frequent speaker on export documentation and compliance issues and has published several articles on the topic.